Soldo, A Spend Management Fintech, Has Closed A Record $180 Million Series C Round

Soldo, the leading European pay and spend automation platform, today announced the completion of a $180 million Series C investment round, a European record in the spend management category. Temasek, a significant global investor headquartered in Singapore, led the funding.

Sunley House Capital, Advent International's crossover fund, and Citi Ventures are among the new investors in the round, which also includes debt funding from Accel, Battery Ventures, Dawn Capital, and Silicon Valley Bank. Goldman Sachs served as Soldo's exclusive placement agent for the transaction.

Despite the adverse macroeconomic situation, this investment follows a 4x increase in spend volume throughout Soldo's platform since series B. The European pay and spend automation platform from Soldo provides organisations with real-time visibility and expense control across all departments. Soldo will be able to continue accelerating product development and market expansion across Europe's $170 billion addressable market as a result of the fundraising round.

Soldo is uniquely positioned to assist businesses in managing their spend, having served over 26,000 customers ranging from small and mid-market to multinational corporation in over 30 countries. Whether it's in the travel and entertainment industry, internet advertising, vendor management, software subscriptions, or anything else. Mercedes-Benz, GetYourGuide, Gymshark, Bauli, and Brooks Running are among its clients.

Carlo Gualandri, Soldo's CEO and Founder, stated: "We are thrilled to have Temasek on board as the lead investor. Temasek's insights will be beneficial to us as we scale our platform and product, given they have a track record of investing in category-leading fintechs. Managing business spend is expensive and difficult, but Soldo continues to demonstrate its value and ease of use to customers of all sizes and industries. This category will undoubtedly increase exponentially as more firms realise the benefits, and Soldo is ideally positioned to assist them."

Corporate payments have traditionally been made via a few methods: bank transfers and corporate credit cards. Each of these solutions comes with its own set of administrative headaches and security threats. Of course, once the transactions are completed, there is a blur of receipts, expenditure reports, classification and reconciliation, budgeting, and analysis – none of which are linked. Soldo is the digital solution to this enormously expensive problem.

According to Simon Lambert, a director at Sunley House, Advent International's crossover fund: "We are thrilled to be investing in Soldo. Our background in software and payments technology provides us with a unique perspective, and we are certain that Soldo will be at the forefront of financial digitalization. We are excited to work with the company's great management team to establish Europe's premier pay and spend automation platform in a broad and rapidly growing market."

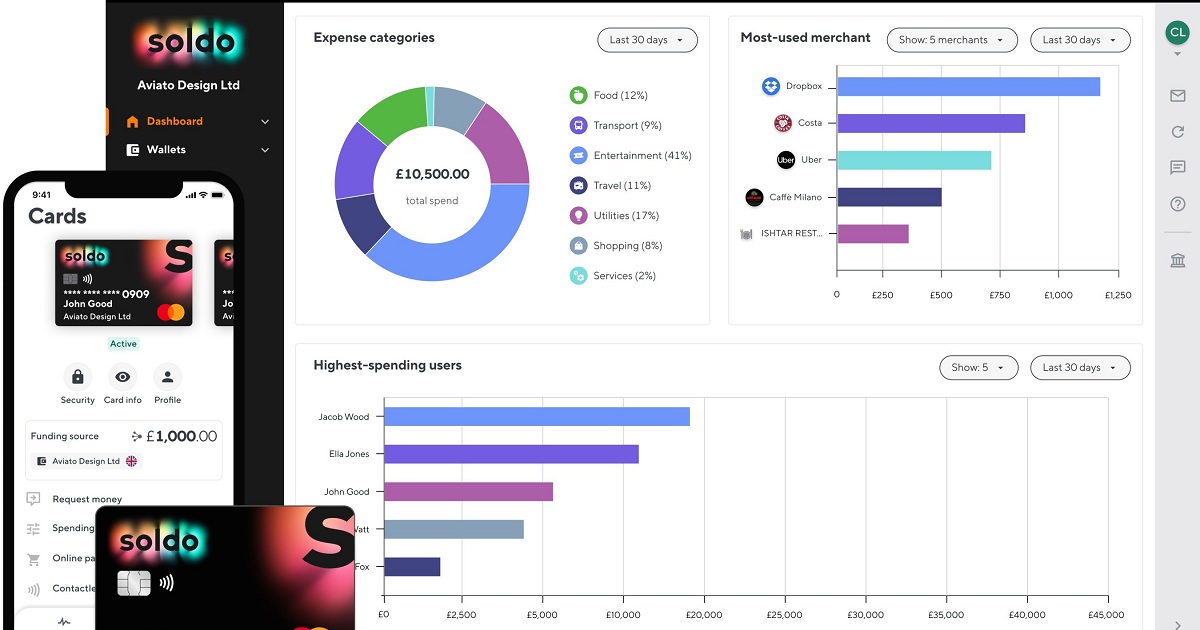

Soldo's spend management platform, which has been under development for five years, is built on a wholly owned technological stack and is supported by regulated financial services and payments infrastructure. Customers may connect with 50+ cost management platforms, including Concur and Expensify, using Mastercard Smart Data, allowing Soldo to innovate faster and integrate with top accounting software such as NetSuite, QuickBooks, Zucchetti, and Xero.

Citi Ventures Managing Director Luis Valdich stated: "Citi Ventures was struck by Soldo's intriguing strategy and game-changing aim to assist businesses better manage and control their spending. We are excited to work with the company as it extends its platform and impacts the future of business spending."

Soldo also makes life easier for employees who have to deal with difficult expense reports, misplaced receipts, and are frequently out of pocket. The mobile app enables receipt and transaction capture at the point of sale.

"We know senior finance employees and CFOs presently spend more than half of their time on tedious duties, and the major cause for this is due to unconnected payment systems and manual, time-consuming processes," stated Mariano Dima, Soldo President.

"In a survey of CFOs and finance directors, Soldo discovered that lax expenditure controls are costing European firms 2% of their annual revenue due to the pandemic."

This is an expensive reality that Soldo hopes to eliminate – by making employees' life easier and businesses more aware of all costs – because only then will they be able to truly control their expenditure and thrive post-pandemic and beyond."

Soldo raised $61 million in Series B funding in July 2019 and has since grown dramatically in size, employing over 200 people across locations in London, Dublin, Rome, and Milan. The fresh amount of funding will allow the company to hone in on new regions such as Benelux, France, and Germany, where Soldo sees enormous potential for hyper-growth.

About Soldo

Soldo is a European pay and spend automation technology that integrates Mastercard® smart corporate cards with comprehensive management software. Soldo is used by over 26,000 firms, ranging from tiny businesses to multinational corporations, in over 31 countries to manage and control expenditure.

Soldo, headquartered in the United Kingdom, with offices in Dublin, Milan, and Rome, enables customers such as Mercedes-Benz, GetYourGuide, Gymshark, Bauli, and Brooks Running to spend business money on travel and entertainment, advertising, purchases, software subscriptions, e-commerce, and more. Custom budgets and real-time transaction tracking allow financial decision-makers to regulate every expenditure.

Begin spending more wisely.

We are honoured to have the backing of some of the world's most influential investors, including Accel, Battery Ventures, Citi Ventures, Dawn, Silicon Valley Bank, Advent International, and Temasek.

About Temasek

Temasek is a Singapore-based investment firm with a net portfolio value of S$381 billion (€241 billion, £206 billion) as of March 31, 2021.Temasek Charter specifies its three duties as an Investor, Institution, and Steward, as well as its attitude of doing well, doing right, and doing good. It aspires to facilitate answers to important global concerns as a provider of catalytic finance. With sustainability at the heart of all Temasek does, it actively pursues sustainable solutions to current and future challenges, as well as investible opportunities to ensure a sustainable future for everybody.